Z Forex

Well-known member

- Messages

- 340

- Likes

- 1

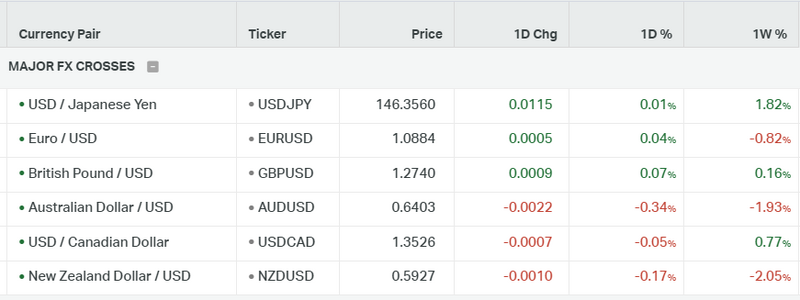

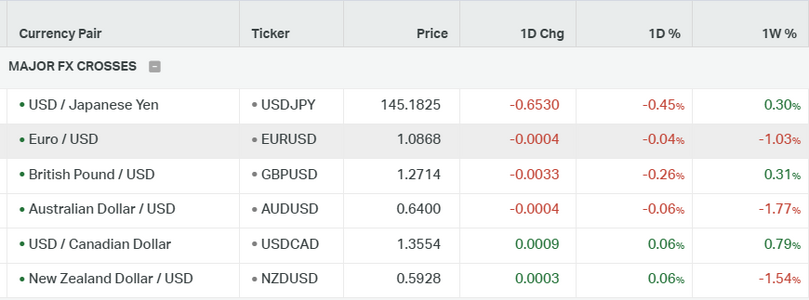

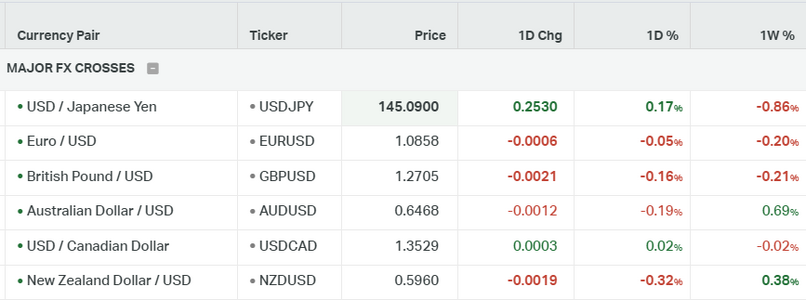

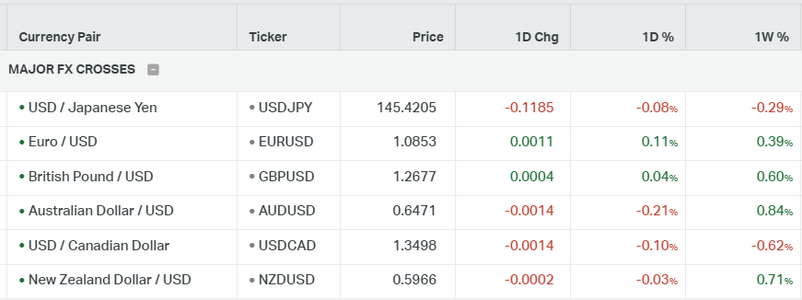

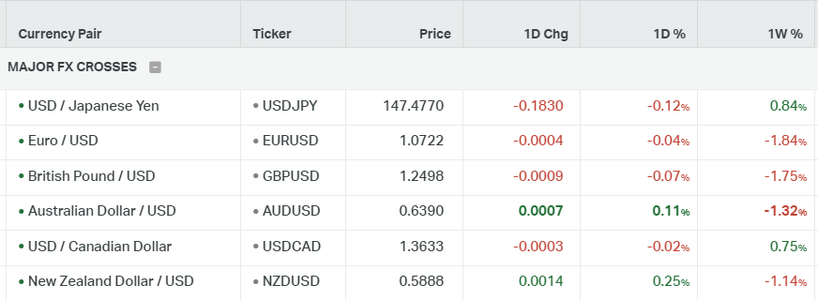

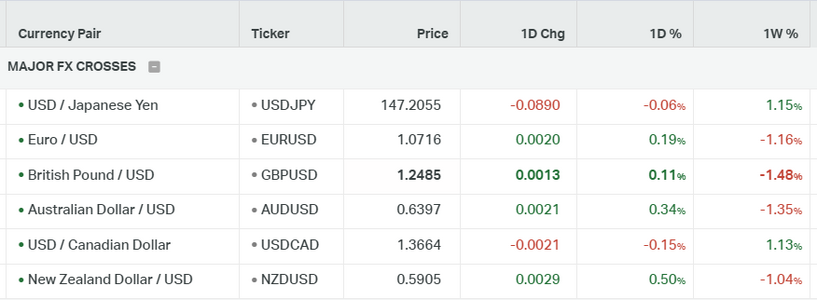

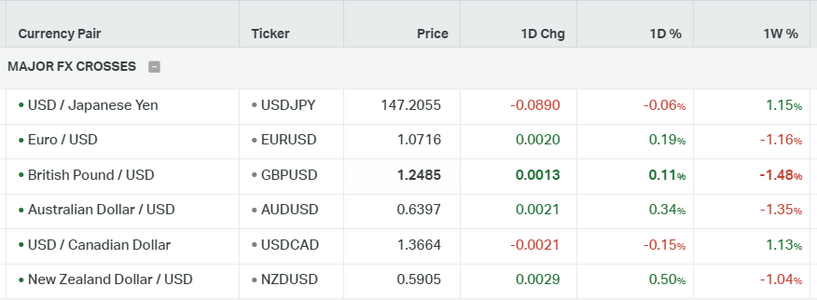

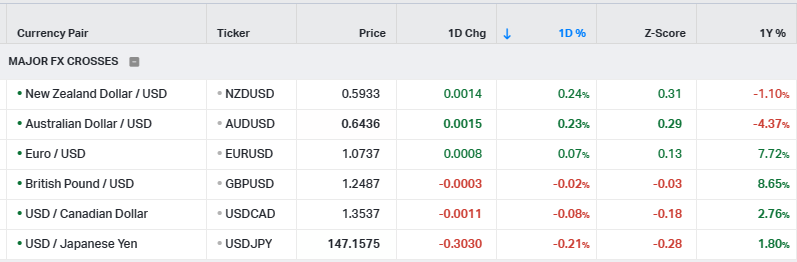

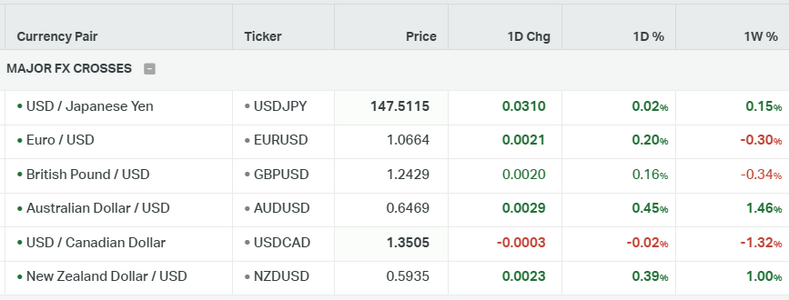

EURUSD

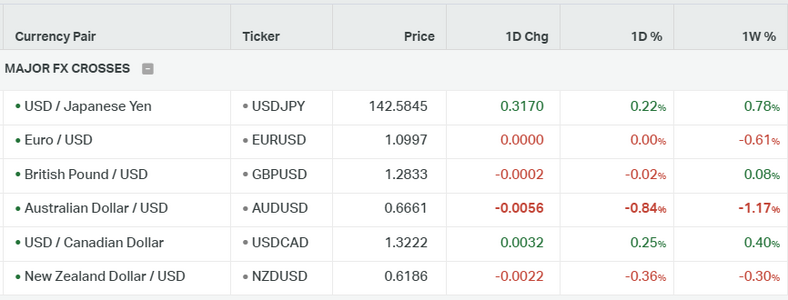

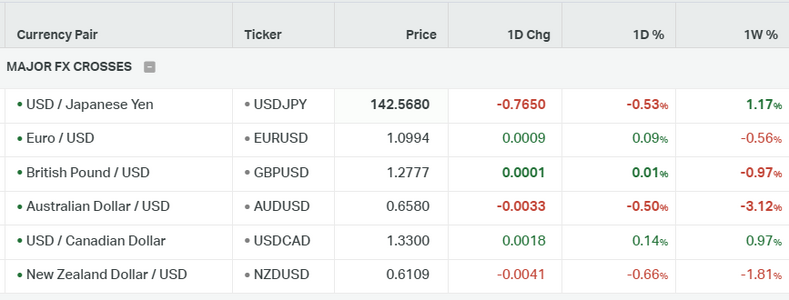

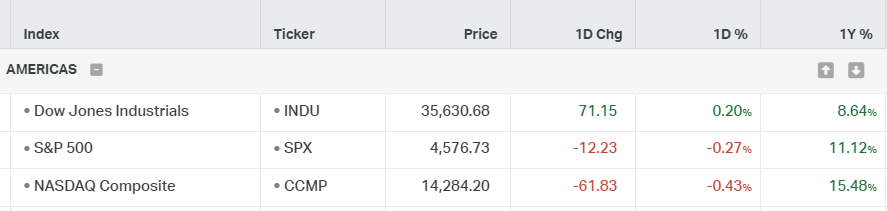

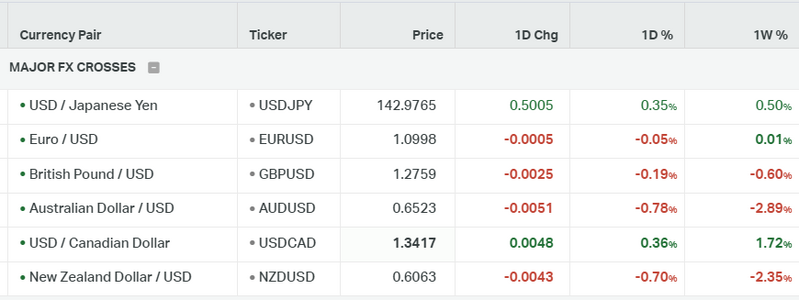

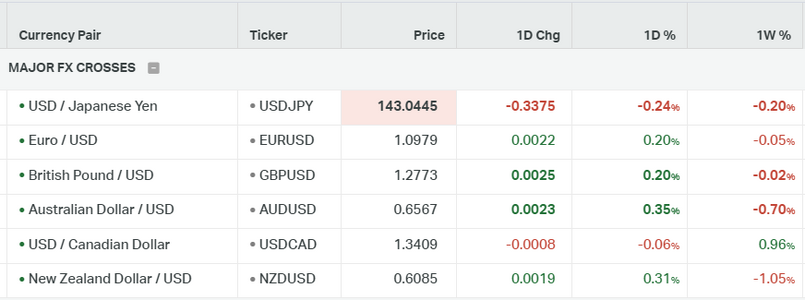

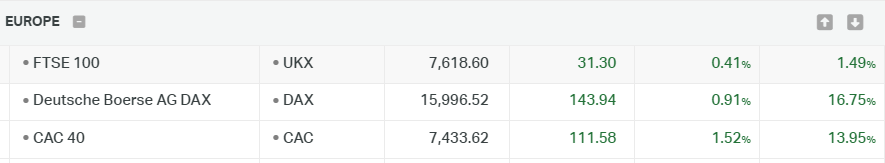

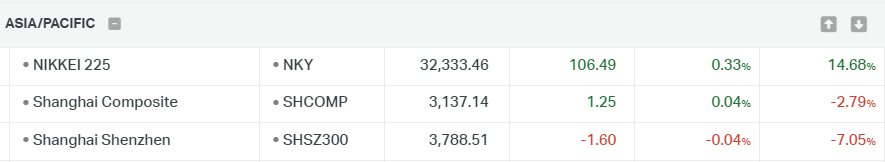

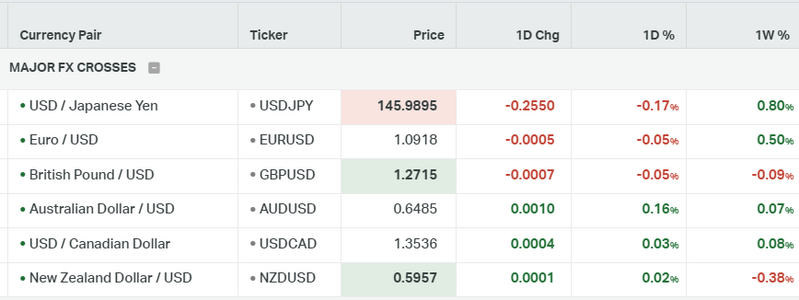

Eurozone HICP in July rose by 5.5% YoY, and headline CPI increased by 5.3%. Q2 Eurozone GDP grew by 0.3% QoQ and 0.6% YoY. German Retail Sales in June rose by 1.6% YoY, beating expectations. The European Central Bank raised interest rates to 4.25% but hinted at a possible pause in September due to easing inflationary pressures. In the US, the PCE Price Index fell to 3% in June, and the Core PCE Price Index dropped to 4.1% YoY. The US Dollar strengthened to 102.00 on Tuesday, despite softer US inflation data. Market participants will focus on global Manufacturing PMI and Germany's Unemployment rate. The US Nonfarm Payrolls report on Friday is expected to show 180,000 new jobs and a 3.6% employment rate.

The EUR/USD, after yesterday's correction, encountered resistance at the 1.1045 level and is currently continuing the selloff, now in the downtrend of the long bullish channel. The DXY is also touching the resistance area at 102. On a daily basis, the 100MA serves as the next target for EURUSD at 1.0900.

The EUR/USD, after yesterday's correction, encountered resistance at the 1.1045 level and is currently continuing the selloff, now in the downtrend of the long bullish channel. The DXY is also touching the resistance area at 102. On a daily basis, the 100MA serves as the next target for EURUSD at 1.0900.

| Resistance 3 | Resistance 2 | Resistance 1 | Support 1 | Support 2 | Support 3 |

| 1.1140 | 1.1090 | 1.1050 | 1.0950 | 1.0900 | 1.0850 |

GBPUSD

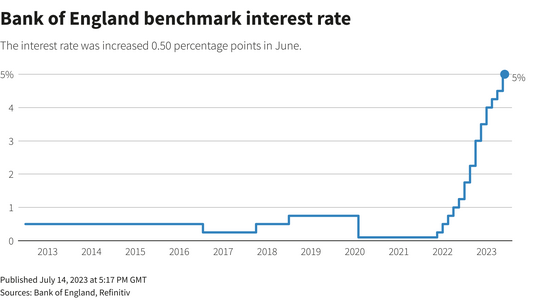

The US Dollar has strengthened due to prospects of tighter policies by the Federal Reserve, supported by a strong US GDP report. Worries about a downturn in China also contribute to the USD's safe-haven appeal. However, optimism over more Chinese stimulus and expectations of the Fed ending its rate hike cycle might cap the USD's gains. On the other hand, expectations of more interest rate hikes by the Bank of England could support the British Pound. Market participants are also looking at upcoming economic data and key policy meetings for further trading opportunities.

The GBP/USD moved without direction at the beginning of this week. The next support is around the down parallel of the long bullish trend at the 1.2750 level. The resistance level is at 1.2900.

The GBP/USD moved without direction at the beginning of this week. The next support is around the down parallel of the long bullish trend at the 1.2750 level. The resistance level is at 1.2900.

| Resistance 3 | Resistance 2 | Resistance 1 | Support 1 | Support 2 | Support 3 |

| 1.3220 | 1.3150 | 1.3000 | 1.2800 | 1.2750 | 1.2650 |

JPYUSD

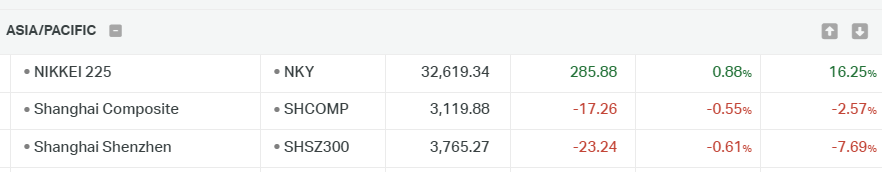

The Japanese Yen is being impacted by the Bank of Japan's policy shift. The BoJ Governor has granted more flexibility to the Yield Curve Control (YCC), maintaining interest rates while making bond-buying operations easier. The central bank also conveyed a strong message about possibly moving away from its long ultra-dovish policy.

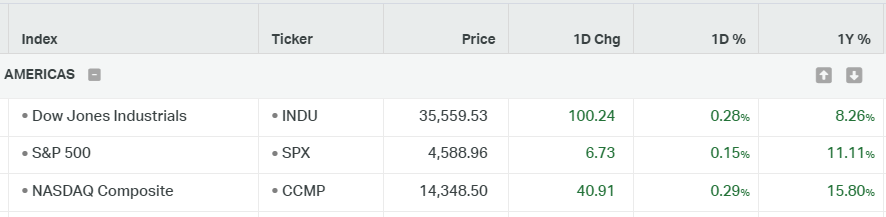

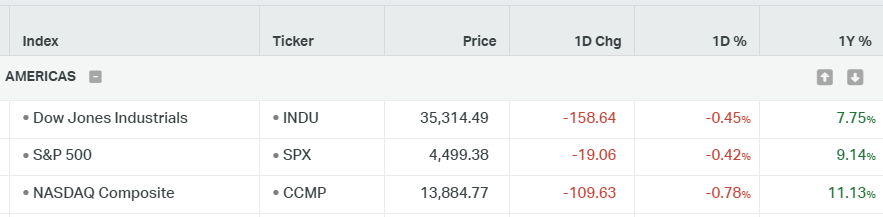

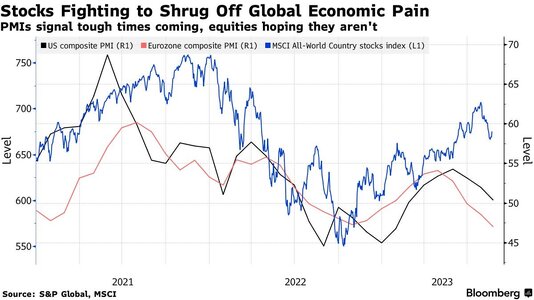

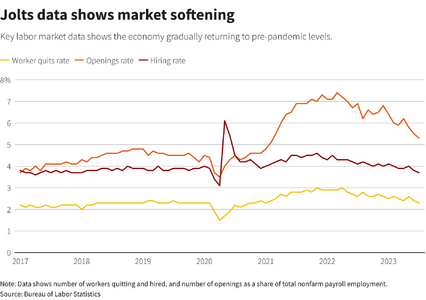

Investors are anticipating the United States Manufacturing PMI for July, which will be reported by the Institute of Supply Management (ISM). The economic data is projected to continue its eight-month contracting trend, influenced by higher interest rates set by the Federal Reserve (Fed). US factory activities are expected to reach 46.5, surpassing the previous release of 46.0.

USDJPY broke the 142.00 resistance level and is now at the median level of the long bullish channel at 143.00. Meanwhile, the yields on Japanese bonds continue to rise.

Investors are anticipating the United States Manufacturing PMI for July, which will be reported by the Institute of Supply Management (ISM). The economic data is projected to continue its eight-month contracting trend, influenced by higher interest rates set by the Federal Reserve (Fed). US factory activities are expected to reach 46.5, surpassing the previous release of 46.0.

USDJPY broke the 142.00 resistance level and is now at the median level of the long bullish channel at 143.00. Meanwhile, the yields on Japanese bonds continue to rise.

| Resistance 3 | Resistance 2 | Resistance 1 | Support 1 | Support 2 | Support 3 |

| 142.00 | 141.20 | 140.22 | 138.70 | 137.70 | 135.50 |

XAUUSD

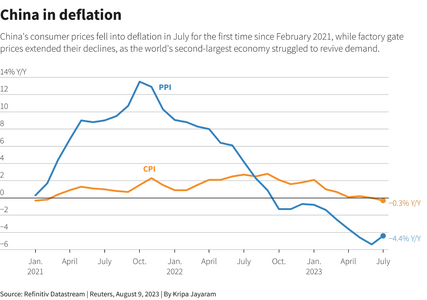

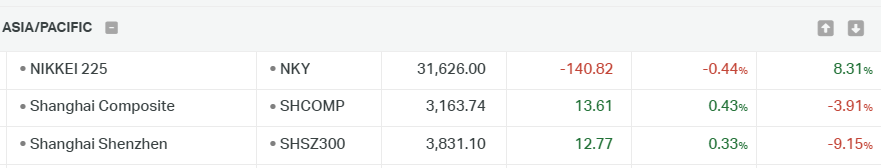

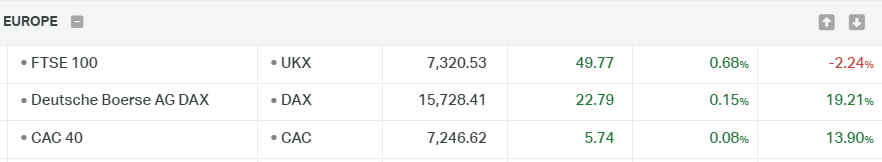

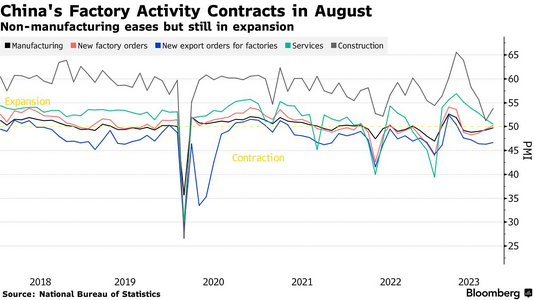

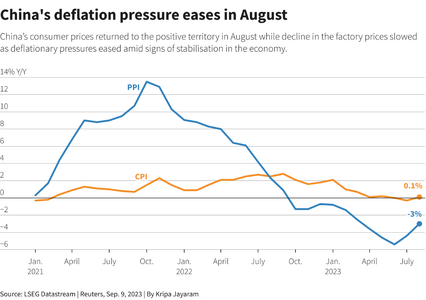

In July, the Chinese Caixin Manufacturing PMI fell to 49.2, the lowest level since January, impacting precious metals due to China's status as a major gold consumer. The Manufacturing PMI slightly improved to 49.3 but remained below 50, indicating contraction. Meanwhile, the NBS Services PMI declined from 53.2 to 51.5.

In the United States, evidence of easing underlying price pressures may prompt the Fed to soften its hawkish stance, potentially limiting the US Dollar's strength and supporting the gold price. The PCE Price Index decreased to 3% in June, while the Core PCE Price Index was at 4.1% annually.

Trade tensions between the US and China over technology access may add pressure to the gold price. China announced export restrictions on certain drones and equipment to the US.

Market participants are awaiting various US economic data, including the ISM Manufacturing PMI, JOLTS Job Openings, ADP Private Employment, Weekly Jobless Claims, Unit Labor Cost, and the Nonfarm Payrolls (NFP) report, which could influence USD price dynamics and create short-term trading opportunities around gold. The Sino-US relationship remains a focal point in the market. The gold came back after finding resistance at the mean line at the 1972.5 and the next support is at the 1948 level.

In the United States, evidence of easing underlying price pressures may prompt the Fed to soften its hawkish stance, potentially limiting the US Dollar's strength and supporting the gold price. The PCE Price Index decreased to 3% in June, while the Core PCE Price Index was at 4.1% annually.

Trade tensions between the US and China over technology access may add pressure to the gold price. China announced export restrictions on certain drones and equipment to the US.

Market participants are awaiting various US economic data, including the ISM Manufacturing PMI, JOLTS Job Openings, ADP Private Employment, Weekly Jobless Claims, Unit Labor Cost, and the Nonfarm Payrolls (NFP) report, which could influence USD price dynamics and create short-term trading opportunities around gold. The Sino-US relationship remains a focal point in the market. The gold came back after finding resistance at the mean line at the 1972.5 and the next support is at the 1948 level.

| Resistance 3 | Resistance 2 | Resistance 1 | Support 1 | Support 2 | Support 3 |

| 1982 | 1970 | 1960 | 1940 | 1931 | 1920 |

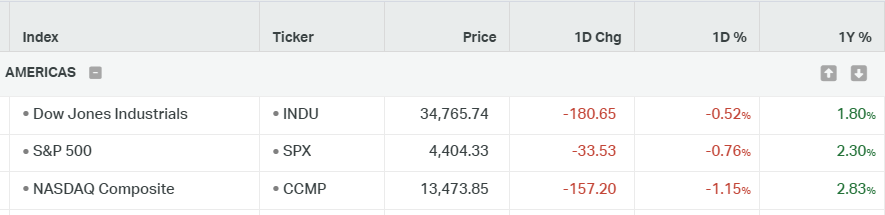

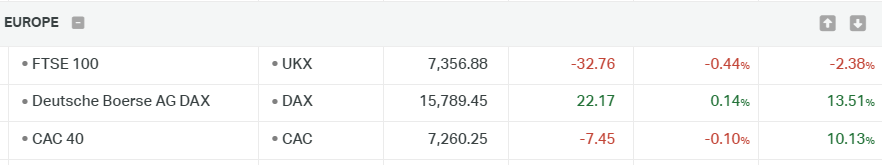

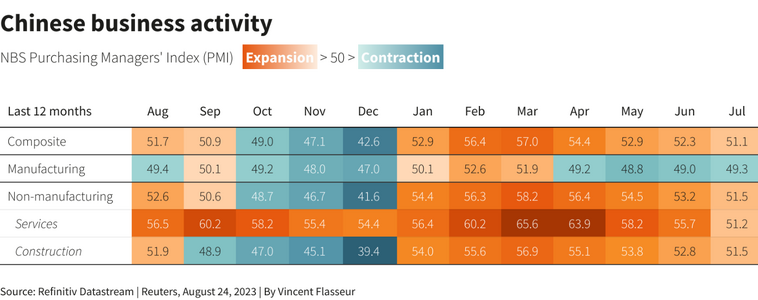

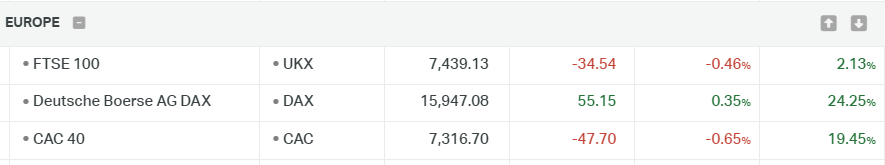

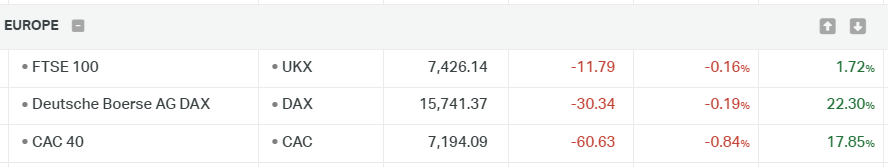

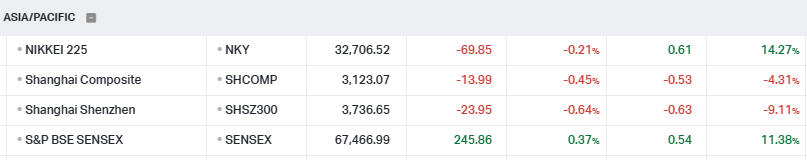

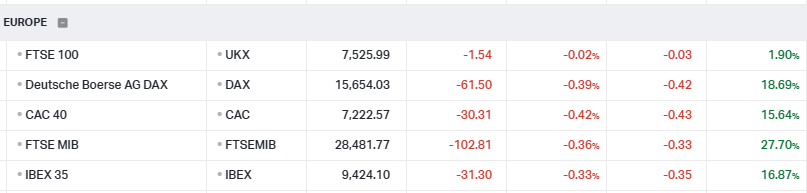

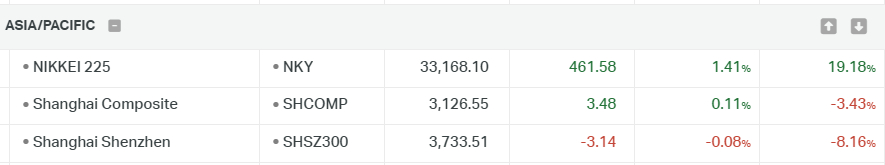

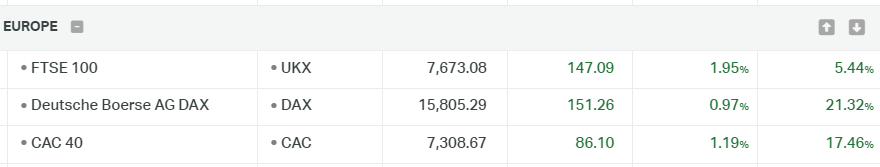

DAX40

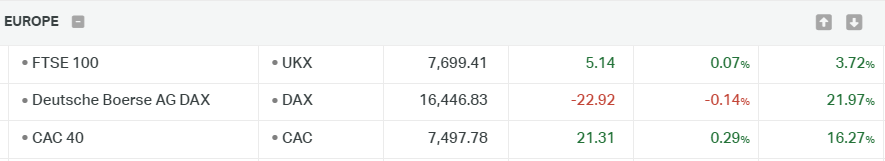

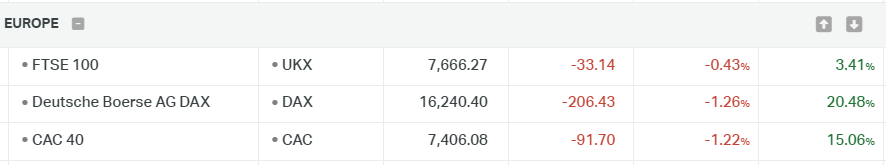

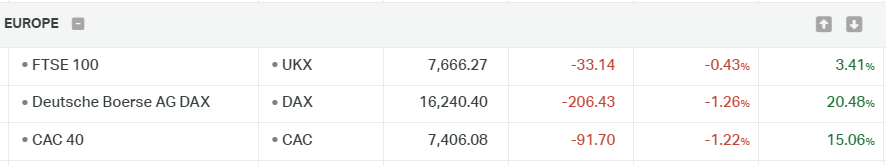

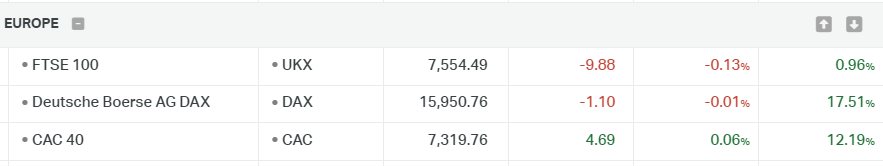

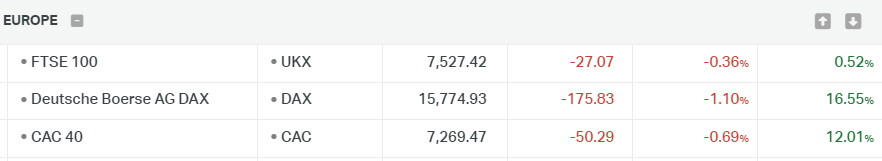

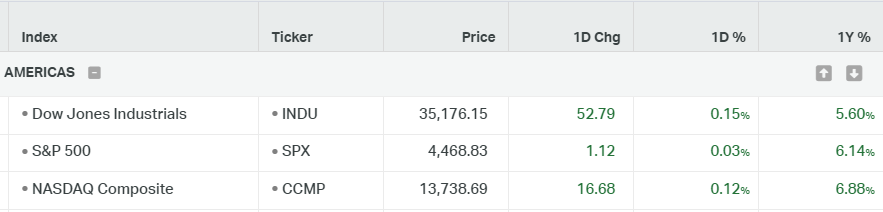

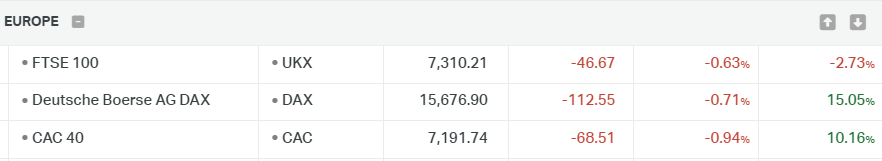

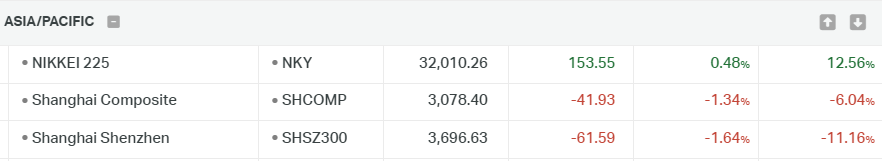

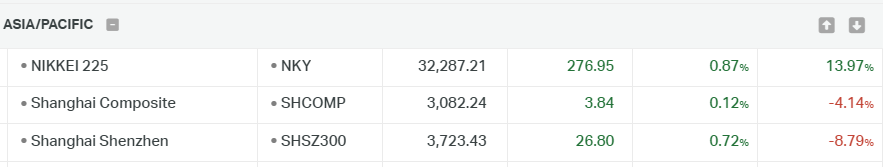

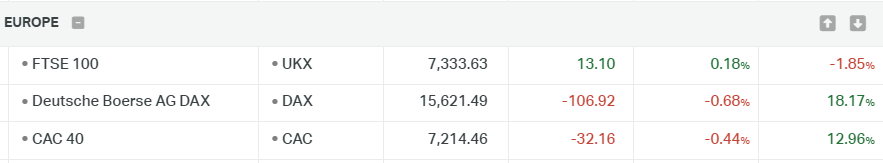

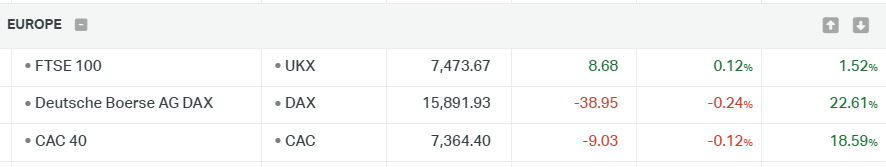

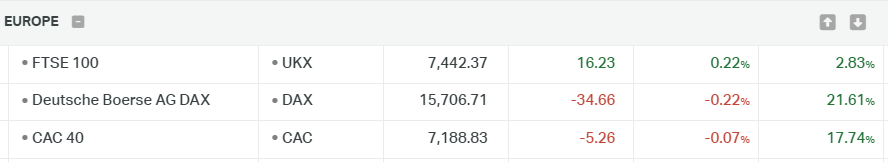

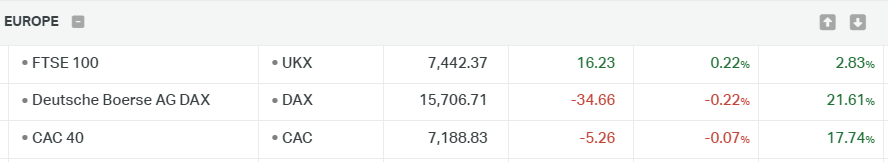

European stocks slipped on Tuesday as weak factory activity data from Asia and some disappointing earnings stalled a rally in markets that had pushed several regional indexes to multi-year highs recently.

Asia's factory activity shrank in July, private surveys showed, a sign slowing global growth and weakness in China's economy was taking a toll on the region's fragile recovery. Eurozone factory surveys are due later in the day. Among companies that reported, DHL Group DHL fell 3% after the freight forwarder reported a slump in quarterly earnings as high inflation, the war in Ukraine and the ongoing energy crisis weighed on consumer demand and freight rates.

The main news in Europe is from earnings, with oil giant BP boosting its dividend despite a 70% fall in profit and HSBC launching a $2 billion buyback after profit beat forecasts.

DAX signaling a possible comeback as economic activity and economic data don’t show positive results and the possibility of a recession is growing even if yesterday's GDP in Europe was positive for the last quarter. The last support level is around 16220.

Asia's factory activity shrank in July, private surveys showed, a sign slowing global growth and weakness in China's economy was taking a toll on the region's fragile recovery. Eurozone factory surveys are due later in the day. Among companies that reported, DHL Group DHL fell 3% after the freight forwarder reported a slump in quarterly earnings as high inflation, the war in Ukraine and the ongoing energy crisis weighed on consumer demand and freight rates.

The main news in Europe is from earnings, with oil giant BP boosting its dividend despite a 70% fall in profit and HSBC launching a $2 billion buyback after profit beat forecasts.

DAX signaling a possible comeback as economic activity and economic data don’t show positive results and the possibility of a recession is growing even if yesterday's GDP in Europe was positive for the last quarter. The last support level is around 16220.

| Resi Level 3 | Resi Level 2 | Resi Level 1 | Suppo level 1 | Suppo level 2 | Suppo level 3 |

| 16600 | 16400 | 16200 | 15650 | 15400 | 15200 |

Attachments

Last edited by a moderator: