SOLIDECN

Senior member

- Messages

- 2,881

- Likes

- 0

How China’s Banks Support the Yuan Against Moody’s Outlook

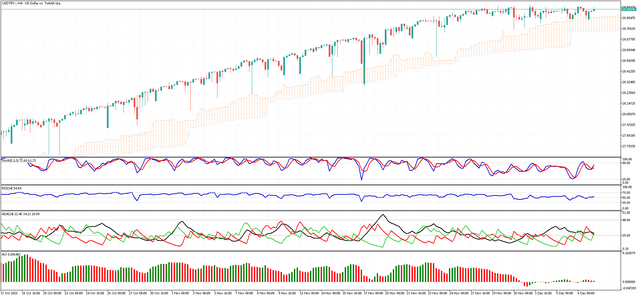

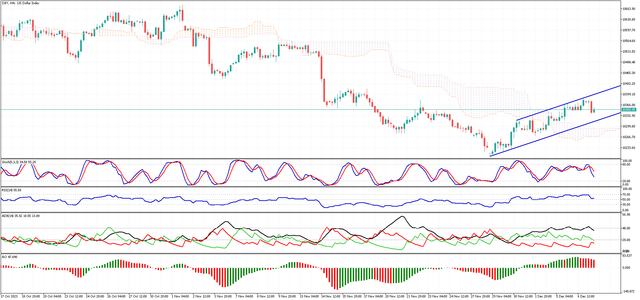

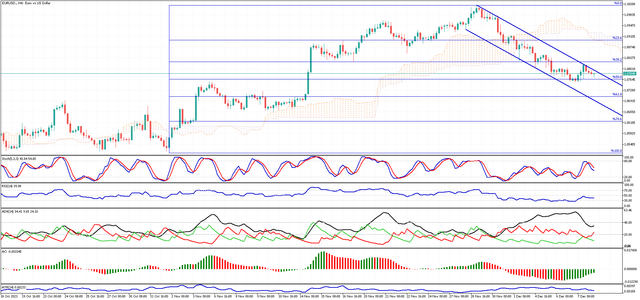

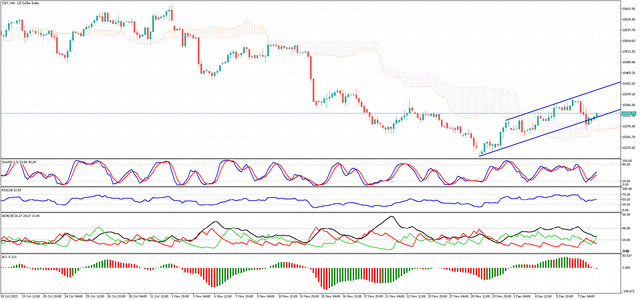

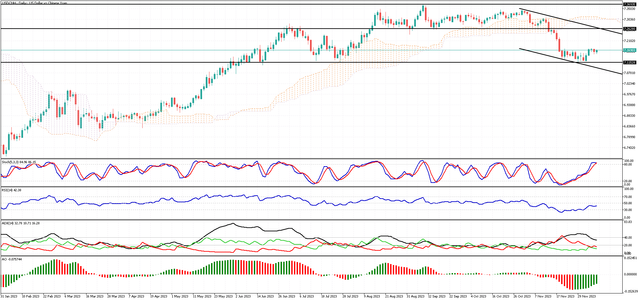

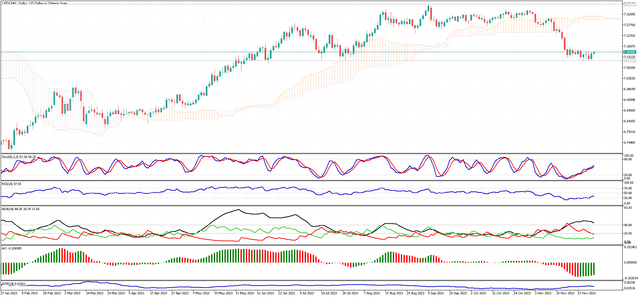

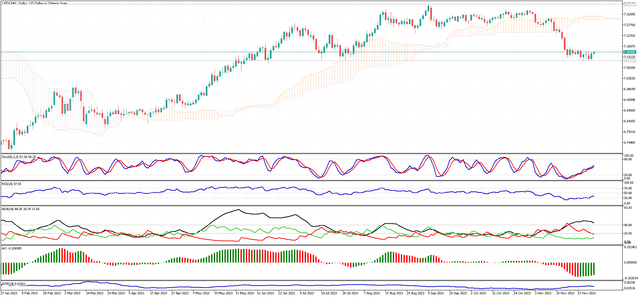

The yuan stays the same even though Moody’s lowers China’s credit outlook. The USDCNH did not change much at around 7.15 per dollar, because big state-owned banks in China sold dollars, balancing out Moody’s move to lower China’s credit outlook.

Chinese banks swapped yuan for US dollars in the onshore market and then sold those dollars in the spot market. This action helped keep the yuan steady and reduce the worries caused by Moody’s about slower economic growth and possible risks in China’s property sector. Also, a survey showed that China’s services activity increased the most in three months in November.

The yuan stays the same even though Moody’s lowers China’s credit outlook. The USDCNH did not change much at around 7.15 per dollar, because big state-owned banks in China sold dollars, balancing out Moody’s move to lower China’s credit outlook.

Chinese banks swapped yuan for US dollars in the onshore market and then sold those dollars in the spot market. This action helped keep the yuan steady and reduce the worries caused by Moody’s about slower economic growth and possible risks in China’s property sector. Also, a survey showed that China’s services activity increased the most in three months in November.