algotraderxl

Newbie

- Messages

- 1

- Likes

- 0

Hello friends, the event we call Dump in the market is inevitable and difficult to catch. For this reason, I will try to explain how to catch these dumps using the Traderlands algo-trading platform (free). In this example, we will create a rule on the ARBUSDT pair. Let's proceed step by step.

Step 1:

Let's look at the ARB chart on Tradingview.

After September 10, there is a 15% drop.

Step 2:

Let's look at the ARB on the 1-hour chart.

There is a drawdown starting at 07:00 and notice the volume at the bottom.

Step 3:

Let's look at the 5 min chart for more detailed data.

The bearish bar that started at 07:20 had 47 times more volume than the average of the last 10 bars.

Step 4:

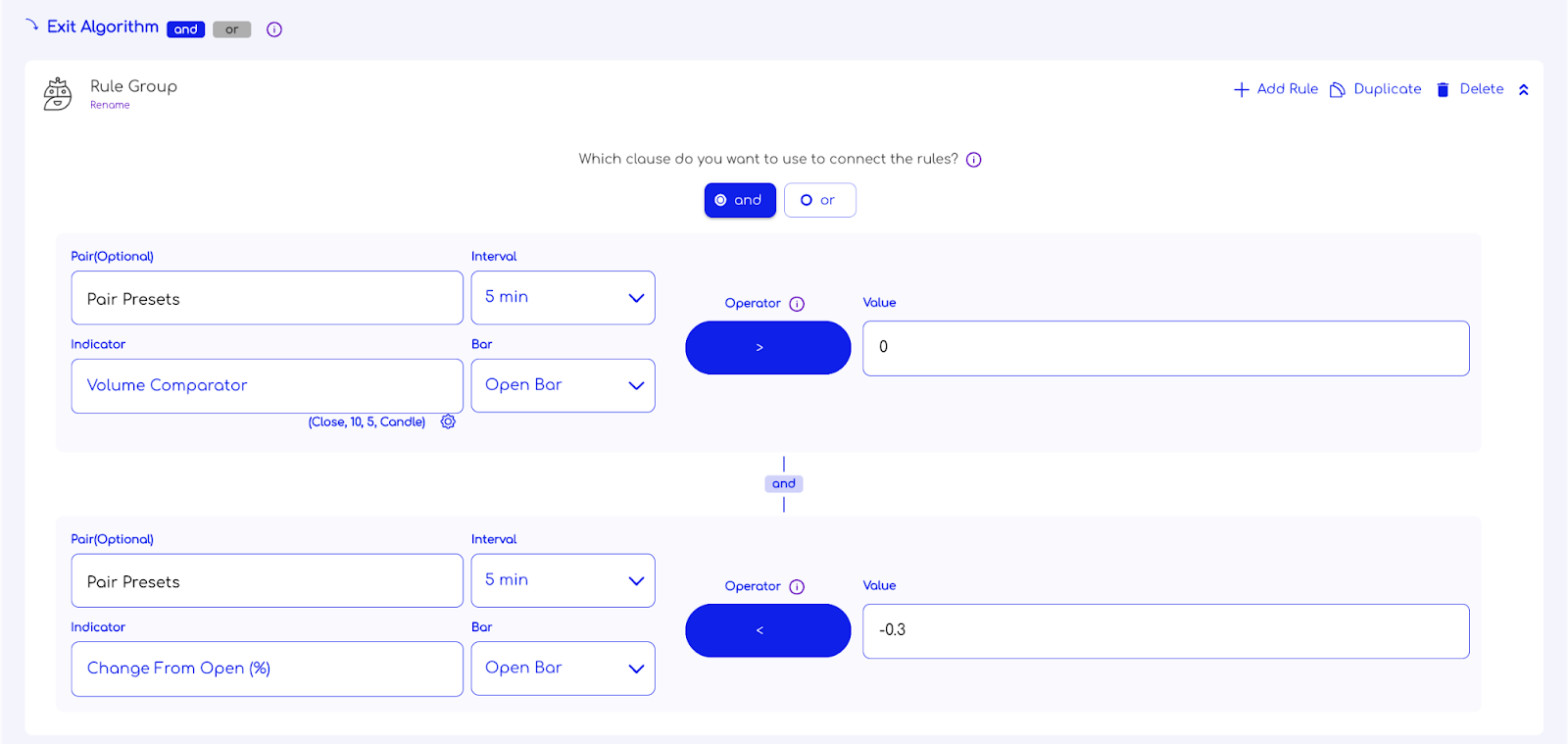

Formulating a strategy.

If the instant candle average on the 5 min chart is 5 times more than the average volume of the last 10 bars AND

If the candle's decline rate is even more than -0.5% on the 5 min chart

Suppose you have caught a dump.

It is very simple to set this up on Traderlands. This is how it works;

Step 5:

Let's calculate the exit point manually according to these conditions.

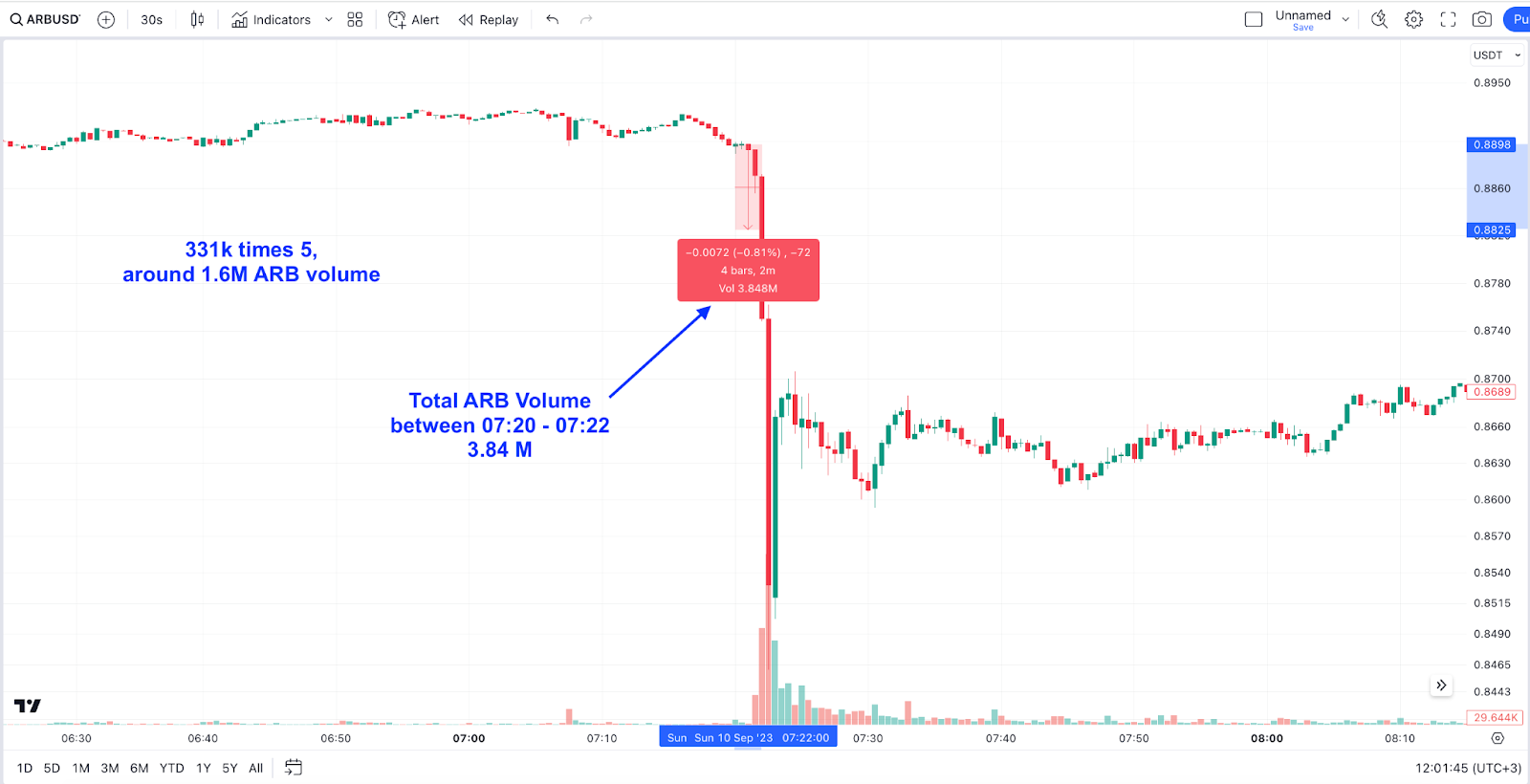

Looking at the 30 sec chart, the 5 min rules for which we set up the strategy will be recalculated for every 5 min. When we add up the volumes of 30 secs each in the 07:20 candle, we can see that ~3.84 M ARB volume was made in 3 min.

The 331k we set here is 5 times the average, well above the 1.6 M ARB volume. The exit price is estimated to be 0.8790.

On a daily scale;

As you can see, this strategy saved us from a loss of 0.8% instead of 15%. And Traderlands would have done it for us at 07:23 in the morning while we were sleeping.

This point can also be considered as a possible SHORT buy point.

Step 1:

Let's look at the ARB chart on Tradingview.

After September 10, there is a 15% drop.

Step 2:

Let's look at the ARB on the 1-hour chart.

There is a drawdown starting at 07:00 and notice the volume at the bottom.

Step 3:

Let's look at the 5 min chart for more detailed data.

The bearish bar that started at 07:20 had 47 times more volume than the average of the last 10 bars.

Step 4:

Formulating a strategy.

If the instant candle average on the 5 min chart is 5 times more than the average volume of the last 10 bars AND

If the candle's decline rate is even more than -0.5% on the 5 min chart

Suppose you have caught a dump.

It is very simple to set this up on Traderlands. This is how it works;

Step 5:

Let's calculate the exit point manually according to these conditions.

Looking at the 30 sec chart, the 5 min rules for which we set up the strategy will be recalculated for every 5 min. When we add up the volumes of 30 secs each in the 07:20 candle, we can see that ~3.84 M ARB volume was made in 3 min.

The 331k we set here is 5 times the average, well above the 1.6 M ARB volume. The exit price is estimated to be 0.8790.

On a daily scale;

As you can see, this strategy saved us from a loss of 0.8% instead of 15%. And Traderlands would have done it for us at 07:23 in the morning while we were sleeping.

This point can also be considered as a possible SHORT buy point.