HelloHi Steven,

Thanks for the reply.

I don't doubt that having a sound understanding of statistics is likely to be helpful to all traders. That said, I presume you don't expect beginners or experienced traders alike to take a minimum of one - and preferably two - 20 week classes in statistics simply in order to be able to understand your methodology?

Re, VWAP - I plotted it at the start of last Mondays session to cover the entire week - as you specifically refer to weekly VWAP in your previous post. So, you're now recommending a daily VWAP plotted at the start of each session - is this correct?

You write: "If the POC is above the VWAP the skew is down, conversely if the POC is below the VWAP the skew is up." That's clear enough, but you don't mention where price is in relation to the two indicators. Is it relevant - does it matter?

Tim.

Now that I have advised you as to how to prepare, I have no further concern. Choose as you wish

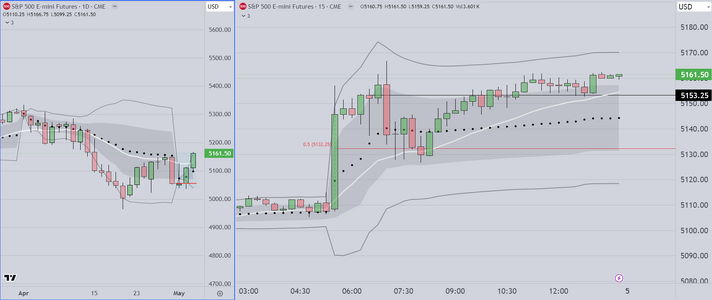

As regards whether to use weekly or daily data for the higher time frame chart, It doesn't matter

Markets are fractal, so you can use either time frame.

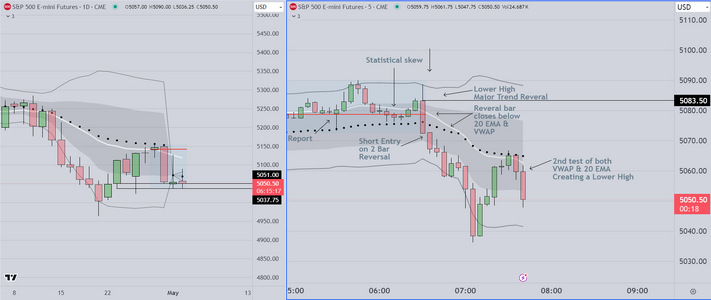

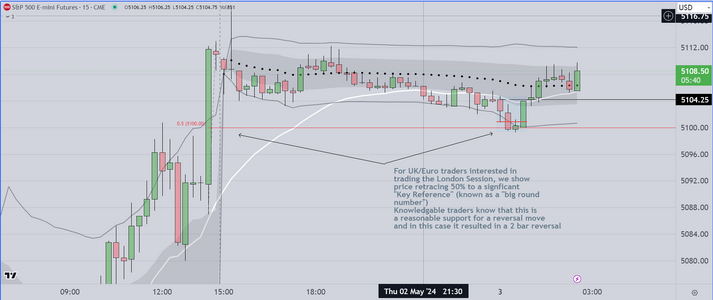

As regards price action relative to skew. for a positive skew, you want price to be trending up. and

For a negative skew, trending down. When the POC is at or very near the VWAP, there is no statistical

tendency up or down Traders with a background in stats, characterize this as a "symmetrical" or

"Trading Range" market, requiring knowledge of how to trade using limit orders. I don't expect to

be posting long enough to cover that subject matter.